The Capital Drain

Why Uncertainty - Not Hurricanes - Breaks Insurance Markets

Reveals why Florida's insurance crisis stems from policy uncertainty, not hurricanes—explaining how political decisions drive capital away faster than any storm

Translates complex economic principles through vivid metaphors (poker in the dark, ducks quacking in different languages) that make market dynamics understandable to all readers

Provides actionable solutions based on global case studies and decades of legislative experience, showing exactly how to restore market stability

Demonstrates why predictable rules and pre-storm preparation beat post-storm politics, offering a clear path to sustainable, available insurance coverage

Not ready to buy yet? No problem. Get started with a free sample chapter today.

The Capital Drain

Why Uncertainty - Not Hurricanes -Breaks Insurance Markets

When hurricanes strike Florida, insurance companies adapt and rebuild—but when politicians change the rules without warning, capital flees and doesn't return.

Drawing on his unique perspective as both an insurance agent and one of only two legislators who voted against Florida's disastrous 2007 insurance reforms, Don D. Brown reveals the hidden force destroying coastal insurance markets: policy uncertainty, not natural disasters. Through accessible metaphors and real-world data, this book demonstrates how retroactive rule changes, extended deadlines, and political interventions create an "ambiguity load" that doubles premiums and drives insurers away. Brown traces the problem from ancient Babylonian risk-sharing through modern catastrophe bonds, showing how markets successfully price hundred-billion-dollar storms but cannot price political chaos.

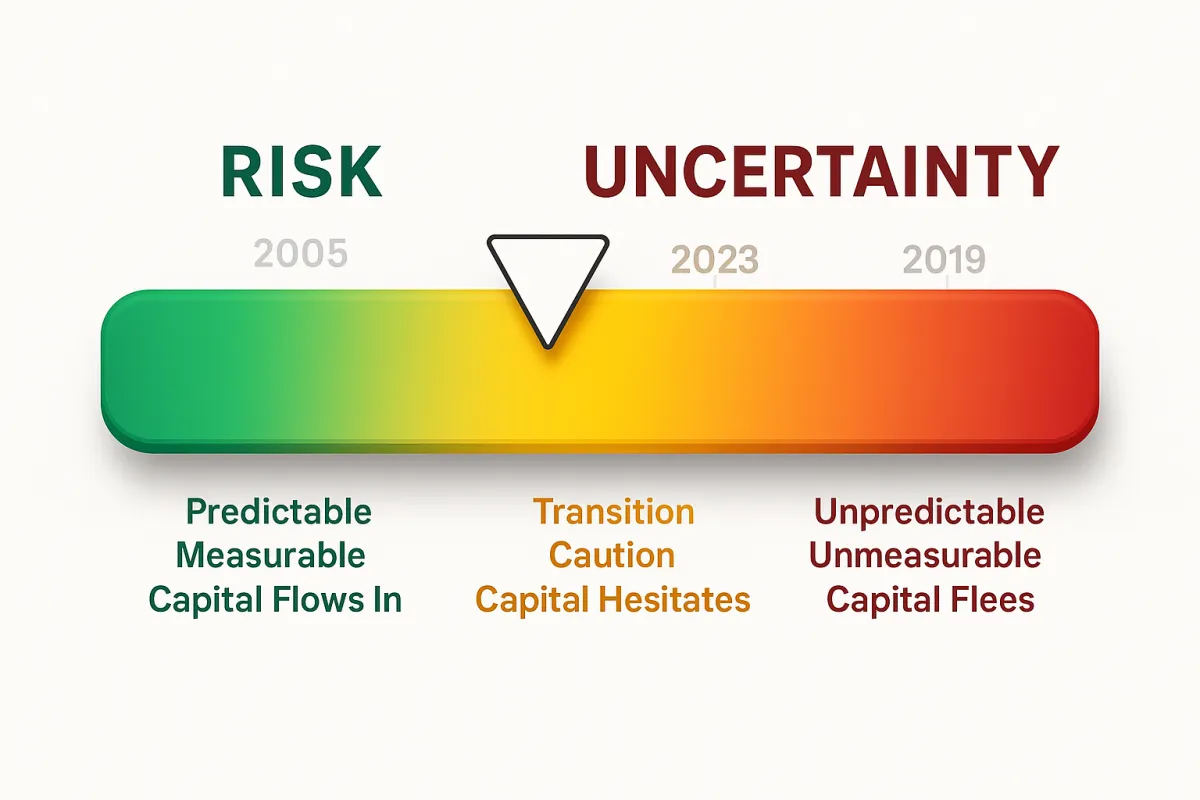

The book presents concrete solutions drawn from successful programs worldwide—from Japan's earthquake insurance to the UK's Flood Re—that prove stability is achievable even in disaster-prone regions. Using the Risk-Uncertainty Spectrum as a framework, readers learn to evaluate whether policies move markets toward manageable risk or destructive uncertainty. Brown argues that Florida doesn't need gentler weather or government subsidies; it needs predictable rules, honest pricing, and investment in pre-storm mitigation.

The Capital Drain offers policymakers a detailed roadmap and homeowners an explanation for their soaring premiums, while providing investors the framework to understand when to commit capital and when to withdraw.

Benefits Of Book

Demystifies Premium Increases - Explains exactly why insurance costs have tripled in Florida while storms haven't gotten three times worse

Provides Actionable Policy Solutions - Offers specific, tested reforms that can stabilize markets within 12-18 months

Translates Complex Economics - Makes sophisticated concepts accessible through memorable metaphors and real-world examples

Empowers Informed Decision-Making - Equips readers to evaluate whether proposed legislation will help or harm insurance availability

Reveals Global Best Practices - Shows what works in other disaster-prone markets and how to adapt those lessons to Florida

Offers Historical Context - Traces how we got here and why previous "solutions" failed, preventing repetition of costly mistakes

Selected Quotes from the Book

The Invisible Tax on Prudence

"When statutes wobble, when courts broaden promises that were never priced, when timelines and penalties are written for blue-sky Tuesdays instead of gray-sky months, the market hears a siren it cannot ignore. Hurricanes break roofs; uncertainty breaks markets. And when markets break, every household pays a quiet tax for our refusal to write a steady rulebook—a tax that shows up in renewal notices that shock, carriers that exit, and coverage that vanishes when families need it most."

Risk Has Odds, Uncertainty Doesn't

"Risk can be priced. Uncertainty cannot. Risk has odds—even ugly odds. Uncertainty doesn't. If you honor that line, capital behaves. If you blur it, capital bolts. Markets will fund your hurricane risk at scale when the rules are visible, prospective, and enforceable. They cannot fund ambiguity that traps cash for a year while coverage and fee disputes metastasize into systemic severity."

The Joseph Principle for Modern Insurance

"Long before spreadsheets and solvency ratios, a young administrator warned his ruler that weather would turn. Store during fat years so people can eat in lean years. Florida doesn't face famine of grain but famine of capital. When the granaries of the insurance system—surplus, reinsurance, and pre-event backstops—are full when storms arrive, recovery is logistics and patience. When bins are empty, we improvise with emergency bonds and hurried shifts that create tomorrow's crisis."

Poker with Cards vs. Poker in the Dark

"A Florida wind layer with clear wordings and stable claim practice is poker with cards—volatile but intelligible. A layer written under statutes that wobble, fee rules that multiply after landfall, or retroactive reinterpretations is poker in the dark. Investment committees don't argue about how much to bet at that table; they argue about whether to sit down at all."

Capital is Like Water

"Capital flows toward stability and evaporates in the heat of uncertainty. At the green end of our spectrum, capital pours in—reinsurers compete, premiums stay stable, coverage remains available. Push into the red zone of uncertainty, and capital evaporates altogether. Insurers withdraw, state-run entities swell with risk they cannot manage, and consumers face higher costs or no coverage at all."

Predictability as Consumer Protection

"Predictability is not a gift to companies; it is justice for households who plan in good faith. When we change rules mid-stream, we don't just spook capital; we punish prudence. Families that saved, mitigated, and insured find themselves financing the ambiguity created elsewhere. The courage in catastrophe policy isn't dramatic gestures—it's the discipline to write rules that stand in sunshine and rain."

PURCHASE OPTIONS

*Avaliable in PDF, ePUB, Mobi & Kindle.

Choice #1: Book with access to downloads

Choice #2: Paperback with access to downloads

Choice #3: Any 3 Books in the Series for a discounted price. Includes access to downloads

Choose an Option

Coming Soon

Complete Book

ePUB, Mobi & Kindle

Hardcover Book

Access to Downloads

19.95

Complete Book

PDF and EPUB

paperback Book

Access to Downloads

Coming Soon

Complete Book

PDF and EPUB

Hardcover Book

Access to Downloads

TESTIMONIALS

What readers are saying

"Loved everything so far"

"Testimonial lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim dolor elit."

- Your Name

"My life changed forever"

"Testimonial lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim dolor elit."

- Your Name

"Highly recommend this"

"Testimonial lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim dolor elit."

- Your Name

ABOUT DON

Author / Consultant / Speaker

Don D. Brown

Join me on a captivating journey as I share the essential insights and strategies I've uncovered while navigating the intricacies of legislation—all while firmly standing for what truly matters.

Don will go LIVE on Facebook and on TikTok and is a sought out host for Podcast and other appearances as well as speaking engagements and Book signings.